While quite a bit of time and research goes into selecting stocks, it is often hard to know when to pull out - especially for first time investors. The good news is that if you have chosen your stocks carefully, you won't need to pull out for a very long time, such as when you are ready to retire. But there are specific instances when you will need to sell your stocks before you have reached your financial goals.

You may think that the time to sell is when the stock value is about to drop - and you may even be advised by your broker to do this. But this isn't necessarily the right course of action.

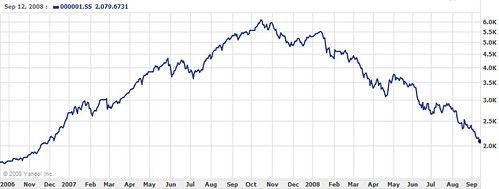

Stocks go up and down all the time, depending on the economy...and of course the economy depends on the stock market as well. This is why it is so hard to determine whether you should sell your stock or not. Stocks go down, but they also tend to go back up.

You have to do more research, and you have to keep up with the stability of the companies that you invest in. Changes in corporations have a profound impact on the value of the stock. For instance, a new CEO can affect the value of stock. A plummet in the industry can affect a stock. Many things - all combined - affect the value of stock. But there are really only three good reasons to sell a stock.

The first reason is having reached your financial goals. Once you've reached retirement, you may wish to sell your stocks and put your money in safer financial vehicles, such as a savings account.

This is a common practice for those who have invested for the purpose of financing their retirement. The second reason to sell a stock is if there are major changes in the business you are investing in that cause, or will cause, the value of the stock to drop, with little or no possibility of the value rising again. Ideally, you would sell your stock in this situation before the value starts to drop.

If the value of the stock spikes, this is the third reason you may want to sell. If your stock is valued at $100 per share today, but drastically rises to $200 per share next week, it is a great time to sell - especially if the outlook is that the value will drop back down to $100 per share soon. You would sell when the stock was worth $200 per share.

As a beginner, you definitely want to consult with a broker or a financial advisor before buying or selling stocks. They will work with you to help you make the right decisions to reach your financial goals.

stock promoters